I am happy to share insights gleaned from our latest Value Index research, an assessment of how well vendors’ offerings meet buyers’ requirements. The 2021 Ventana Research Value Index: Collaborative Analytics and Data is the distillation of a year of market and product research by Ventana Research. See our prior post for a description of our methodology and included vendors.

Analytics almost universally involves collaboration among a team of individuals. Interpreting the results of the analyses, choosing a course of action and tracking the implementation of those actions spans multiple roles and even multiple departments within an organization. As a result, most of today’s analytics and business intelligence products support some form of collaboration. Capabilities that support the sharing of — and communication on — output from analytical processes are important because they help organizations maximize the value of analytics investments. Facilitating communication and collaboration among those involved in the decision-making process leads to more informed and better decisions. Analytics and BI vendors have recognized the value of collaboration and have been increasingly incorporating these capabilities into products.

Analytics almost universally involves collaboration among a team of individuals. Interpreting the results of the analyses, choosing a course of action and tracking the implementation of those actions spans multiple roles and even multiple departments within an organization. As a result, most of today’s analytics and business intelligence products support some form of collaboration. Capabilities that support the sharing of — and communication on — output from analytical processes are important because they help organizations maximize the value of analytics investments. Facilitating communication and collaboration among those involved in the decision-making process leads to more informed and better decisions. Analytics and BI vendors have recognized the value of collaboration and have been increasingly incorporating these capabilities into products.

Social media has introduced significant new collaboration capabilities that can further enhance the analytics process. More than a decade ago, social media tools like Facebook, Twitter and LinkedIn brought on a wave of collaborative analytics and BI capabilities. Our research shows that nearly four in 10 organizations are using collaboration to support analytics processes, and more than one-half said they expect to use these capabilities in the future. We saw chat streams associated with specific analyses that users could like or endorse. The number of contributions a user made to the community was part of his or her profile so others could accordingly weigh the importance of the input. However, after an initial surge of interest, these efforts failed to gain traction and waned. Collaboration requires a large community of active individuals, and there simply were not enough people regularly engaged in using the analytic products. Those early efforts also required users to participate in the dialog from within the analytics and BI products. Unfortunately, rather than working solely with analytics products, line-of-business personnel spend their days using a variety of business applications.

Two major changes now provide the glue to pull a community of collaborators together: mobile devices and enterprise collaboration tools. The significant expansion of mobile analytics and BI has made it easier for users to get involved. Perhaps more importantly, in the same way social media users get notifications of activity via mobile devices, collaborative analytics and BI vendors use mobile notifications to engage a community of participants. Organizations have also adopted more widespread use of enterprise collaboration technologies in place of or in addition to email. Analytics vendors have begun offering integration with those platforms. As a result of both these trends, we see a resurgence in the use of collaborative analytics and BI.

The analytics process typically involves multiple people with differing areas of expertise and responsibilities. Collaborative tools can enable this diverse group of participants to coordinate their activities and share knowledge. To be most effective, collaborative capabilities should cover the entire data and analytics process; only this way can participants understand the provenance of data as it is analyzed.

With this approach, it is easy to identify subject matter experts to engage in the dialog. The team can discuss and document decision-making for compliance purposes, and the actions resulting from those decisions can be assigned and tracked to completion. We expect that by 2024, three-quarters of BI software platforms will include collaborative capabilities designed to support organizations’ decision-making, task management and compliance requirements associated with analytics. These types of capabilities will soon be considered a standard part of data and analytic processes in much the same way that visualization is now standard in these processes.

With this approach, it is easy to identify subject matter experts to engage in the dialog. The team can discuss and document decision-making for compliance purposes, and the actions resulting from those decisions can be assigned and tracked to completion. We expect that by 2024, three-quarters of BI software platforms will include collaborative capabilities designed to support organizations’ decision-making, task management and compliance requirements associated with analytics. These types of capabilities will soon be considered a standard part of data and analytic processes in much the same way that visualization is now standard in these processes.

As organizations embrace more sophisticated analytics such as artificial intelligence and machine learning, and as analytics become more easily accessible via technologies such as natural language processing, collaboration capabilities will become even more important. However, strong collaboration capabilities alone are insufficient. These capabilities also must include strong analytics. Our Value Index assessment takes all these factors into account.

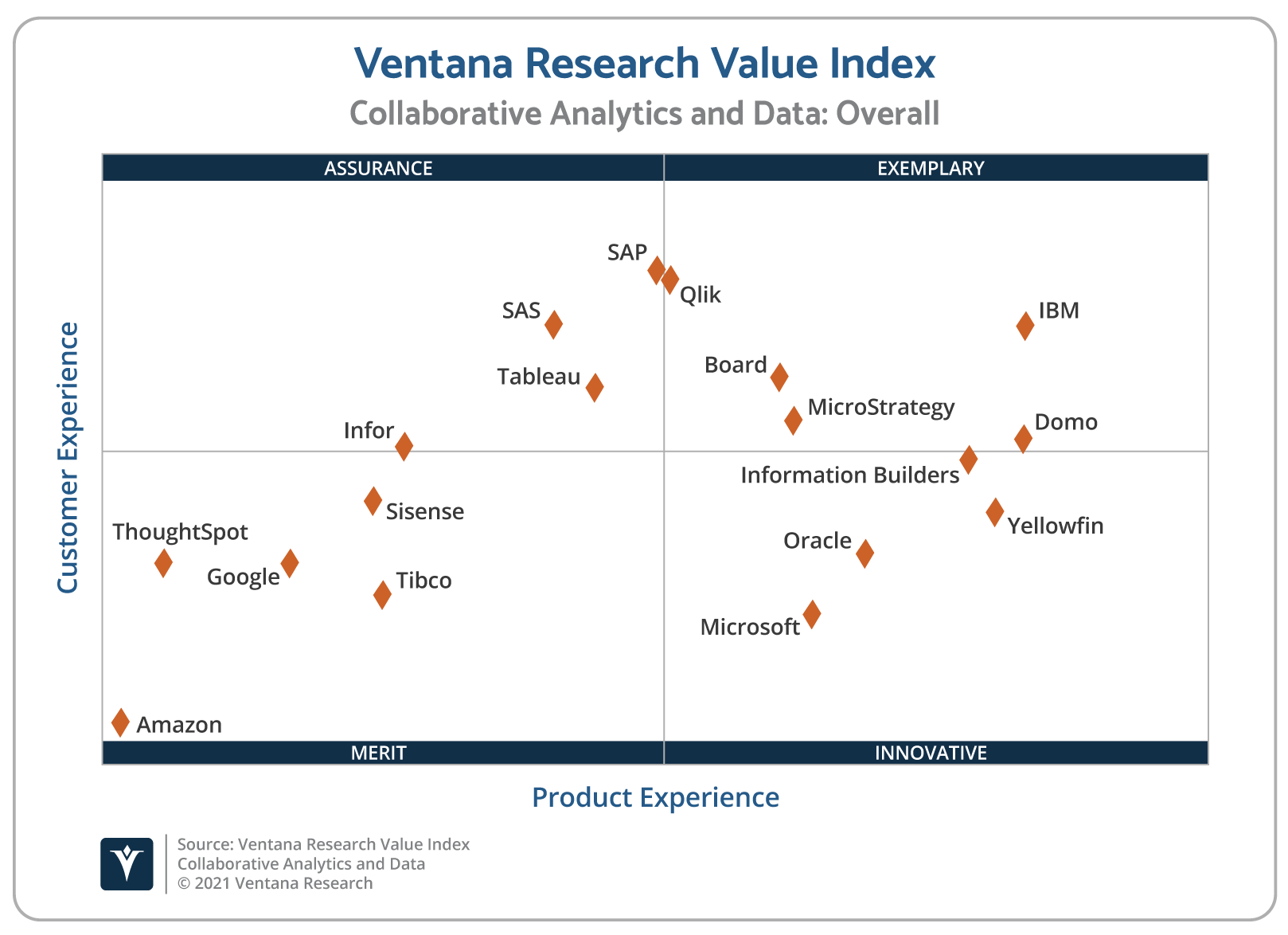

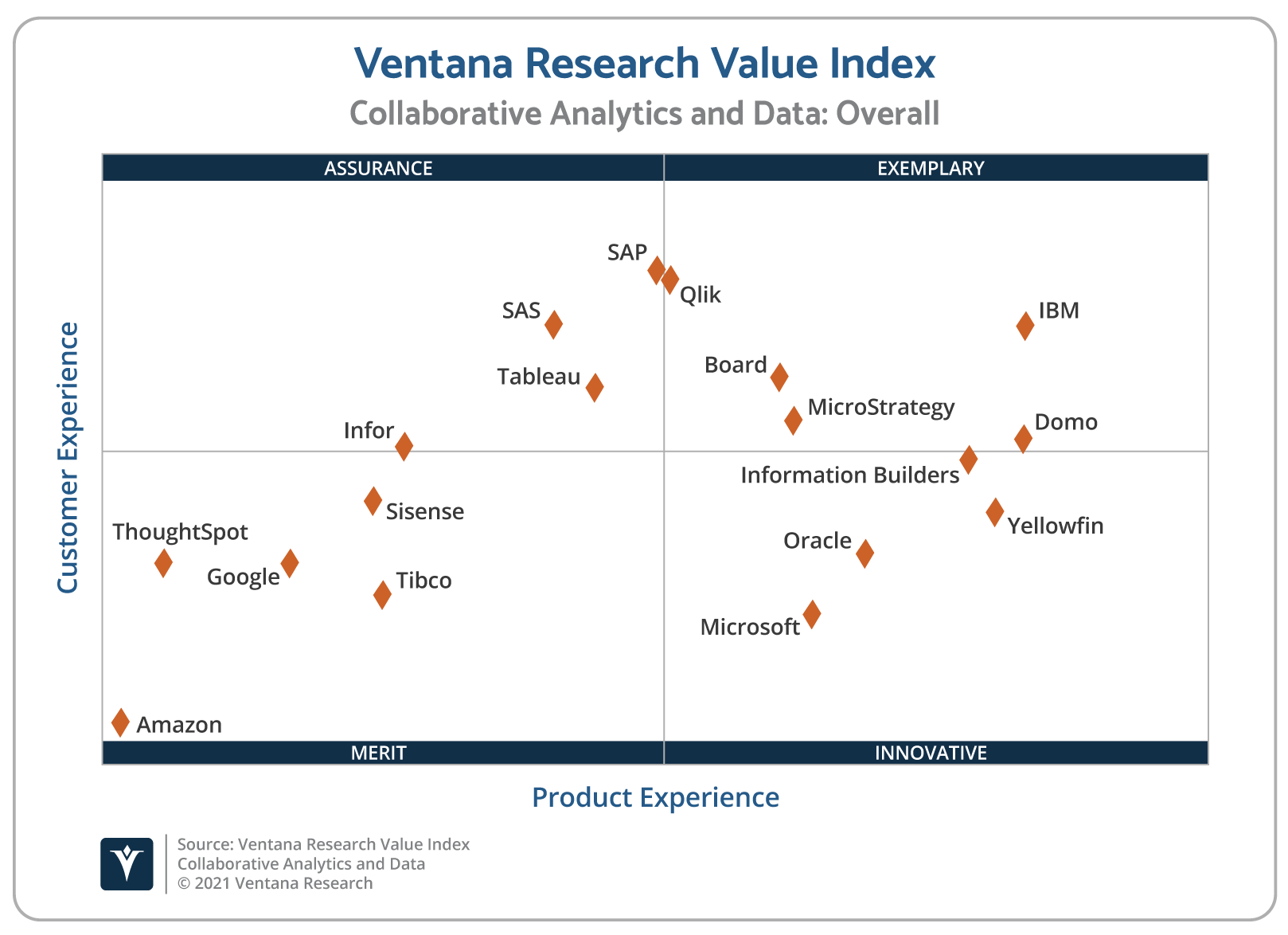

The 2021 Value Index for Collaborative Analytics and Data finds IBM first on the list, with Qlik in second place and Domo in third. Companies that place in the top three in any category earn the designation Value Index Leader, including:

- Qlik in four of the seven categories

- IBM, MicroStrategy and Yellowfin in three categories

- Board and SAP in two categories

- And Domo, Information Builders, Oracle and Tableau in one category.

The results from our research have placed vendors into one of four overall categories: Assurance, Exemplary, Merit or Innovative. The vendors that did well in both product and customer experience were placed as Exemplary: Board, Domo, IBM, MicroStrategy and Qlik. Vendors that performed well in customer experience but did not perform as well in product experience — such as Infor, SAP, SAS and Tableau — are providing Assurance in high levels of customer experience. Vendors with good performance in product experience that did not perform as well in customer experience — such as Information Builders, Microsoft, Oracle and Yellowfin — are classified as Innovative. This representation of the Value Index helps organizations better align vendors with business needs.

As your organization evaluates analytics and data vendors, consider your requirements for collaborative capabilities. Our Value Index assessment provides a valuable source of information to include in your evaluation process. We make it freely available to all. And if you need additional assistance, please fill out our contact us form.

Regards,

David Menninger

Analytics almost universally involves collaboration among a team of individuals. Interpreting the results of the analyses, choosing a course of action and tracking the implementation of those actions spans multiple roles and even multiple departments within an organization. As a result, most of today’s analytics and business intelligence products support some form of collaboration. Capabilities that support the sharing of — and communication on — output from analytical processes are important because they help organizations maximize the value of analytics investments. Facilitating communication and collaboration among those involved in the decision-making process leads to more informed and better decisions. Analytics and BI vendors have recognized the value of collaboration and have been increasingly incorporating these capabilities into products.

Analytics almost universally involves collaboration among a team of individuals. Interpreting the results of the analyses, choosing a course of action and tracking the implementation of those actions spans multiple roles and even multiple departments within an organization. As a result, most of today’s analytics and business intelligence products support some form of collaboration. Capabilities that support the sharing of — and communication on — output from analytical processes are important because they help organizations maximize the value of analytics investments. Facilitating communication and collaboration among those involved in the decision-making process leads to more informed and better decisions. Analytics and BI vendors have recognized the value of collaboration and have been increasingly incorporating these capabilities into products. With this approach, it is easy to identify subject matter experts to engage in the dialog. The team can discuss and document decision-making for compliance purposes, and the actions resulting from those decisions can be assigned and tracked to completion. We expect that by 2024, three-quarters of BI software platforms will include collaborative capabilities designed to support organizations’ decision-making, task management and compliance requirements associated with analytics. These types of capabilities will soon be considered a standard part of data and analytic processes in much the same way that visualization is now standard in these processes.

With this approach, it is easy to identify subject matter experts to engage in the dialog. The team can discuss and document decision-making for compliance purposes, and the actions resulting from those decisions can be assigned and tracked to completion. We expect that by 2024, three-quarters of BI software platforms will include collaborative capabilities designed to support organizations’ decision-making, task management and compliance requirements associated with analytics. These types of capabilities will soon be considered a standard part of data and analytic processes in much the same way that visualization is now standard in these processes.