I am happy to offer some insights on SAS drawn from our latest Value Index research, which provides an analytic representation of our assessment of how well vendors’ offerings meet buyers’ requirements. The Ventana Research Value Index: Analytics and Business Intelligence 2019 is the distillation of a year of market and product research efforts by Ventana Research. We utilized a structured research methodology that includes evaluation categories designed to reflect the breadth of the real-world...

Read More

Topics:

Data Science,

SAS,

Mobile Technology,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Digital Technology

I recently attended the SAS Analyst Summit in Steamboat Springs, Colo. (Twitter Hashtag #SASSB) The event offers an occasion for the company to discuss its direction and to assess its strengths and potential weaknesses. SAS is privately held, so customers and prospects cannot subject its performance to the same level of scrutiny as public companies, and thus events like this one provide a valuable source of additional information.

Read More

Topics:

Big Data,

Predictive Analytics,

SAS,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Information Applications,

Information Management,

Uncategorized,

Visualization

I want to share my observations from the recent annual SAS analyst briefing. SAS is a huge software company with a unique culture and a history of success. Being privately held SAS is not required to make the same financial disclosures as publicly held organizations, it released enough information to suggest another successful year, with more than $2.7 billion in revenue and 10 percent growth in its core analytics and data management businesses. Smaller segments showed even higher growth rates....

Read More

Topics:

Big Data,

Predictive Analytics,

SAS,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Strata+Hadoop

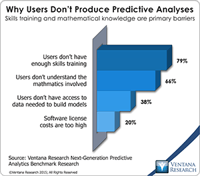

In various forms, business intelligence (BI) – as queries, reporting, dashboards and online analytical processing (OLAP) – is being used increasingly widely. And as basic BI capabilities spread to more organizations, innovative ones increasingly are exploring how to take advantage of the next step in the strategic use of BI: predictive analytics. The trend in Web searches for the phrase “predictive analytics” gives one indication of the rise in interest in this area. From 2004 through 2008, the...

Read More

Topics:

Predictive Analytics,

Predixion,

R,

Revolution Analtyics,

Sales,

Sales Performance,

SAS,

Social Media,

Supply Chain Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Mobility,

Business Performance,

Business Technology,

CIO,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

IBM SPSS,

Information Builders,

Information Technology,

KXEN,

Netezza,

Oracle,

Workforce Performance

I recently attended SAS Institute’s annual analyst conference. My colleague covered the multibillion-dollar company’s strategy and the event. Now I want to look into some of the details of SAS’s products for business analytics and how they are supported with business intelligence (BI), and information management. Although SAS is not a publicly traded company and therefore is not required to make the financial disclosures that others are, the company revealed numerous financial statistics....

Read More

Topics:

SAS,

Social Media,

Analytics,

Business Intelligence,

Business Performance,

Business Technology,

CIO,

Collaboration,

Enterprise Software,

Information Management,

Information Technology,

Mobility,

Operational Intelligence,

IT Performance Management (ITPM)

Read More

Topics:

Data Warehousing,

Microsoft,

RDBMS,

SAS,

Teradata,

Analytics,

Business Intelligence,

Cloud Computing,

Data Management,

HP,

IBM,

Information Management,

Oracle,

IT Performance Management (ITPM)