Having just completed the 2021 Ventana Research Value Index for Analytics and Data, I want to share some of my observations about how the market has advanced since our assessment two years ago. The analytics software market is quite mature and products from any of the vendors we assess can be used to effectively deliver information to help your organization improve its operations. However, it’s also interesting to see how much the market continues to advance and how much investment vendors...

Read More

Topics:

Big Data,

embedded analytics,

Analytics,

Business Collaboration,

Business Intelligence,

Collaboration,

natural language processing,

Conversational Computing,

collaborative computing,

mobile computing,

AI & Machine Learning

Qlik helped pioneer the visual discovery market with its QlikView product. In some respects, Qlik and its competitors also spawned the self-service trend rippling through the analytics market today. Their aim was to enable business users to perform analytics for themselves rather than building a product with the perfect set of features for IT. After establishing success with end users the company began to address more of the concerns of IT, eventually creating a robust enterprise-grade...

Read More

Topics:

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Data Preparation,

Information Management,

Uncategorized,

Visualization,

Qlik,

Qlik Sense

I recently attended the SAS Analyst Summit in Steamboat Springs, Colo. (Twitter Hashtag #SASSB) The event offers an occasion for the company to discuss its direction and to assess its strengths and potential weaknesses. SAS is privately held, so customers and prospects cannot subject its performance to the same level of scrutiny as public companies, and thus events like this one provide a valuable source of additional information.

Read More

Topics:

Big Data,

Predictive Analytics,

SAS,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Information Applications,

Information Management,

Uncategorized,

Visualization

Throughout the course of our research in 2016, we’ll be exploring ways in which organizations can maximize the value of their data. Ventana Research believes that analytics is the engine and data is the fuel to power better business decisions. Several themes emerged from our benchmark research on incorporating data and analytics into organizational processes, and we will follow them in our 2016 Business Analytics Research Agenda:

Read More

Topics:

Big Data,

Predictive Analytics,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Information Applications,

Information Management,

Operational Intelligence

Tibco recently introduced Spotfire 4.0, the most recent version of its interactive discovery and business intelligence (BI) tool. Spotfire comes at BI through visualization. It uses in-memory processing and good user interface design to develop highly interactive displays of data. Version 4.0 attempts to enhance Spotfire’s dashboard capabilities and offers integration with enterprise collaboration tools. The former capabilities are necessary to broaden Spotfire’s appeal and applicability for...

Read More

Topics:

Sales,

Sales Performance,

Social Media,

Spotfire,

Supply Chain Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Chatter,

Collaboration,

Customer & Contact Center,

Dashboards,

Financial Performance,

Tibco,

Twitter,

Workforce Performance

About 30 years ago, perhaps on this very day, I was sitting in front of an Apple II working on a VisiCalc spreadsheet. At the time, I don’t think I even knew who Steve Jobs was. I wasn’t in the software industry yet. I was working for a public accounting firm. The Apple II sat in a corner of the office “typing pool.” For those of you who don’t know what a typing pool was, there was no swimming involved – it was a group of full-time employees with dedicated equipment who did all the typing and...

Read More

Topics:

Mobile,

Sales Performance,

Social Media,

Supply Chain Performance,

Sustainability,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Mobility,

Business Performance,

Customer & Contact Center,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Applications,

Information Management,

Location Intelligence,

Operational Intelligence,

Visualization,

IT Performance Management (ITPM)

InetSoft is a business intelligence vendor that is not well-known but has more than 3,000 customers. Why do you need to know about another BI vendor? As I’ve written in the past, there’s a place in this market for both the megavendors and smaller vendors. InetSoft, one of the latter, has developed a broad set of capabilities over the years that have resonated with its customers. It recently announced and brought to market a significant new release, Style Intelligence 11.

Read More

Topics:

Sales Performance,

Supply Chain Performance,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

CIO,

Customer & Contact Center,

Financial Performance,

InetSoft,

Information Applications

Informatica has announced version 9.1 for Big Data. I wrote previously about Informatica 9.1,the latest iteration of the company’s data integration platform, following its industry analyst summit. At that event in February, the company officials alluded to future plans regarding Hadoop and other big-data sources yet to be finalized. This announcement reveals those plans. Informatica will support three types of “big data”: big transaction data from relational databases and data warehouse system,...

Read More

Topics:

Big Data,

MapReduce,

Social Media,

Supply Chain Performance,

Business Collaboration,

Business Mobility,

Business Performance,

Customer & Contact Center,

Data Integration,

Informatica,

Strata+Hadoop

Earlier this week EMC announced it will create its own distribution for Apache Hadoop. Hadoop provides distributed computing capabilities that enable organizations to process very large amounts of data quickly. As I have written previously, the Hadoop market continues to grow and evolve. In fact, the rate of change may be accelerating. Let’s start with what EMC announced and then I’ll address what the announcement means for the market.

Read More

Topics:

Big Data,

EMC,

Social Media,

Teradata,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Cloudera,

Customer & Contact Center,

Greenplum,

Information Management,

Strata+Hadoop

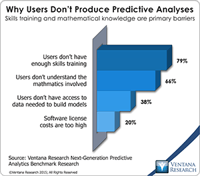

In various forms, business intelligence (BI) – as queries, reporting, dashboards and online analytical processing (OLAP) – is being used increasingly widely. And as basic BI capabilities spread to more organizations, innovative ones increasingly are exploring how to take advantage of the next step in the strategic use of BI: predictive analytics. The trend in Web searches for the phrase “predictive analytics” gives one indication of the rise in interest in this area. From 2004 through 2008, the...

Read More

Topics:

Predictive Analytics,

Predixion,

R,

Revolution Analtyics,

Sales,

Sales Performance,

SAS,

Social Media,

Supply Chain Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Mobility,

Business Performance,

Business Technology,

CIO,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

IBM SPSS,

Information Builders,

Information Technology,

KXEN,

Netezza,

Oracle,

Workforce Performance